Finance Guru Speaks: ECS stands for Electronic Clearing Services.

ECS is an electronic mode of payment/receipt for transactions that are repetitive and periodic in nature. ECS is used by institutions for making bulk payments of amounts towards distribution of dividends, interest, salary, pension, etc., or for bulk collection of amounts towards telephone/electricity/water dues, cess/tax collections, loan installment repayments, periodic investments in mutual funds, insurance premium, etc. Essentially, ECS facilitates bulk transfer of monies from one bank account to many bank accounts or vice versa.

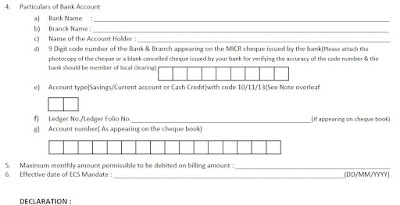

Sample ECS Form:-

|

| Sample ECS Form |

What is a MICR Code?

MICR is an acronym for Magnetic Ink Character Recognition. The MICR Code is a numeric code that uniquely identifies a bank branch participating in the ECS Credit scheme. This is a 9-digit code to identify the location of the bank branch; the first 3 characters represent the city, the next 3 the bank, and the last 3 the branch.

The MICR Code allotted to a bank branch is printed on the MICR band of cheques issued by bank branches.

Advantages of ECS Debit Scheme to the customers:-

The advantages of ECS Debit to customers are many and include,

• ECS Debit mandates will take care of automatic debit to customer accounts on the due dates without customers having to visit bank branches/collection centers of utility service providers etc.

• Customers need not keep track of the due date for payments.

• The debits to customer accounts would be monitored by the ECS Users, and the customers alerted accordingly.

• Cost effective.

Advantages of ECS Debit Scheme to the banking system:-

The banking system has many benefits from ECS Debit such as –

• Freedom from paper handling and the resultant disadvantages of handling, receiving, and monitoring paper instruments presented in the clearing.

• Ease of processing and return for the destination bank branches. Destination bank branches can debit the customers’ accounts after matching the account number of the customer in their database and due verification of the existence of a valid mandate and its particulars. With core banking systems in place and straight-through-processing, this process can be completed with minimal manual intervention.

• Smooth process of reconciliation for the sponsor banks.

• Cost effective.

Can the mandate once given by a customer be withdrawn or stopped?

Yes. Any mandate in ECS Debit is on par with a cheque issued by a customer. The customer has to maintain adequate funds in his / her account with the destination bank branch to ensure the ECS Debit instructions are honored when presented. In case of any need to withdraw or stop a mandate, the customer has to give prior notice to the ECS user institution well in time, to ensure that the input files submitted by the user do not continue to include the ECS Debit details in respect of the mandates withdrawn or stopped by customers.

Is there any limit on the value of Individual transactions in ECS Debit?

No. There is no value limit on the amount of individual transactions that can be collected by ECS Debit.

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks